alameda county property tax payment

Look Up a Home Now. The Alameda County app AC Property is available for iPhone and Android.

Set up an account with your bank.

. Ad Pay Your Taxes Bill Online with doxo. How to change your mailing address. The TTC accepts payments online by mail or over the telephone.

The due date for property tax payments is found on the coupons attached to the bottom of the bill. Alameda County Treasurer Tax Collector 1221 Oak Street Room 131 Oakland CA 94612. Prohibited uses include but are not limited to uses for political campaigns personal matters or profit.

Within a week verify that your check clears with your bank. The fee currently being charged is 225 and it is provided by an outside vendor to facilitate your payment should you be unable to pay the taxes in two installments. These collections are deposited to Union Bank for investments and payment of disbursements made by the offices in the County.

The Alameda County Treasurer-Tax Collector is pleased to announce that the AC Property App is now available on Apple devices. Pay Your Property Taxes By Mobile Property App. Pay online for free using your checking account and the Personal Identification Number PIN which is printed on the Annual Property Tax Bill.

Look Up an Address in Alameda County Today. Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. Last day to pay first installment of property taxes without penalty.

125 12th Street Suite 320 Oakland CA 94607. Note that both current and prior year bills will be displayed after searching by a parcel number. We accept Visa MasterCard Discover and American Express.

A message from Henry C. When researching payments for federal income tax purposes you may need to look at two different. Other Methods To Pay Pay property tax by phone mail in person and wire transfer.

Select from one of the tax types below to research a payment. To make a payment now go to Make Online Payment. Search Secured Supplemental and Prior Year Delinquent Property Taxes.

To request immediate release please contact us at 510272-6800 Monday - Friday 830am - 430pm with your transaction number. You can pay your tax bill by credit card on your mobile device. Use a service like Easy Smart Pay.

View or Pay Property Taxes. Pay current year and supplemental secured and unsecured tax bill. Each electronic check transaction is limited to 99999999.

Keep in mind that paying with the app will not help you avoid the 25 credit card convenience fee. Download it from the iTunes store. Your canceled check is your receipt.

Most supplemental tax bills are payable online to 6302023. We can immediately release liens andor boat holds when paying by credit card. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

You can make your property tax payment through the mail in person online and even on your smartphone. A convenience fee of 25 for a credit card payment will be added to the total tax amount paid online in order to cover the transaction costs charged by financial institutions. Secured tax bills are payable online from 1062021 to 6302022.

You can even pay your property taxes right from the app. The Cashiers Section takes the deposit from the offices within the County and payments of taxes from taxpayers. E-check payments are the same as regular checks and will take thirty 30 days to release a lien.

You can place your check payment in the drop box located at the lobby of the County Administration building at 1221 Oak Street Oakland or through the mail slot at the Business License tax office at 224 W. Ad Tax Records for Alameda County Properties Have Been Digitized. You can lookup your assessed value property taxes and parcel map.

Treasurer Tax Collector Alameda County. Search Unsecured Property Taxes. The following information and services can be accessed with any touch-tone telephone 24-hours a day seven days a week by calling 510 272-6800.

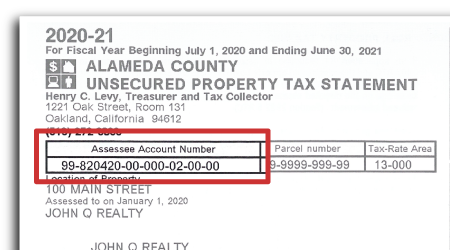

You can also pay using your informational copy stubs that you receive every year by November 1st. Use in the conduct of official Alameda County business means using or operating the Parcel Viewer in the performance of or necessary to or in the course of the official duties and services of Alameda County. If we are going to pay by Echeck we select the value we are going to pay with Echeck option then we fill in the terms acceptance box and click on the Continue To Pay Contact button.

This is a new service that you can use to pay your property tax monthly via an ACH payment or a credit card. Information on due dates is also available 247 by calling 510-272-6800. You may pay by check money order cashiers check or certified check.

Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System. For more information visit our website at. Office hours location and directions.

Order a current secured property tax bill. Search Unsecured Property Taxes. Alameda County Property Taxes Payment With E-check.

The bulk of the payments are received in August for Unsecured Taxes and December and April for Secured Taxes. The tax type should appear in the upper left corner of your bill. When taxes are due and if you have paid the total amount due over.

Request Full and Updated Property Records. Winton Ave Room 169 Hayward. Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100.

Call your lender and Get Set up on an Impound Account. Prior Year Delinquent tax payments are payable online to 6302023. Assessed value exemption and tax payment.

Pay Your Property Tax. How to Pay Your Alameda County Property Taxes. Make checks payable to.

How To Pay Property Tax Using The Alameda County E Check System Youtube

Understanding California S Property Taxes

Transfer Tax Alameda County California Who Pays What

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Piedmont Civic Association Piedmont California Sewer Surcharge And Other Piedmont Parcel Taxes Not Tax Deductible

City Of Oakland Check Your Property Tax Special Assessment

How To Pay Property Tax Using The Alameda County E Check System Alcotube