salt tax cap married filing jointly

The marriage penalty has long been considered an unfair tax that results in a higher tax burden solely based on marital status. However Becourtney said the 10000 SALT deduction.

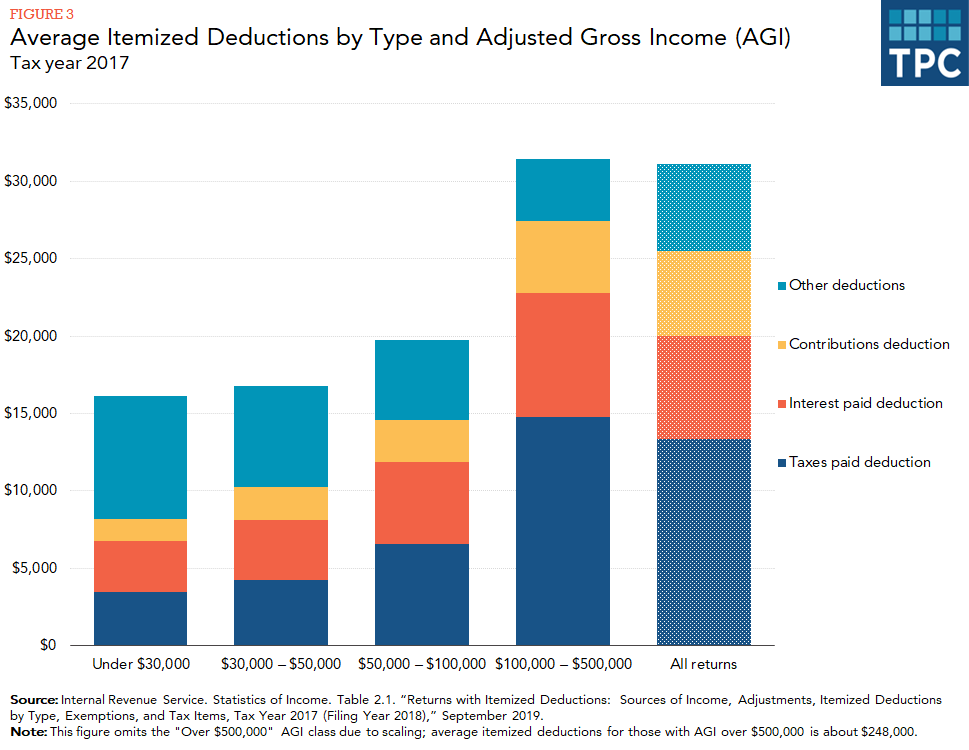

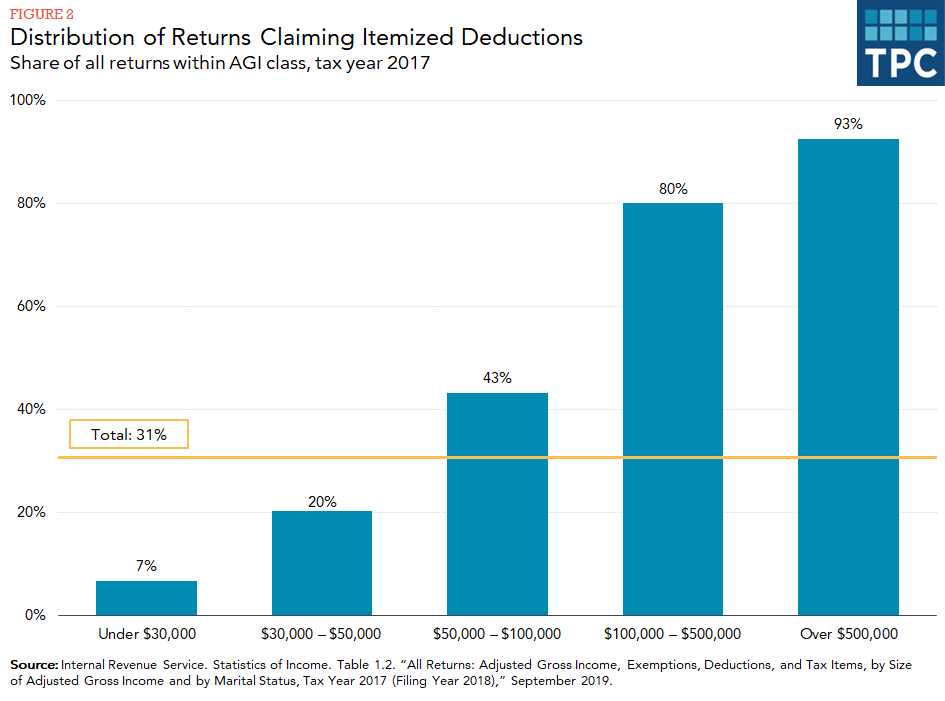

What Are Itemized Deductions And Who Claims Them Tax Policy Center

25100 Married Filing Joint or Qualifying Widow.

. While the TCJA included some tax provisions that reduced the married tax penalty as stated above the 10000 SALT limit increases tax on married taxpayers filing jointly. For married taxpayers filing separately the cap is 5000. My partner and I each received 1099gs in a high tax state.

In the spirit of mitigating the marriage. That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint filer or head of household while married taxpayers filing separately can deduct up to 375000 each09022022. New tax law for 2018.

T he state and local tax SALT. Learn More At AARP. New tax law for 2018.

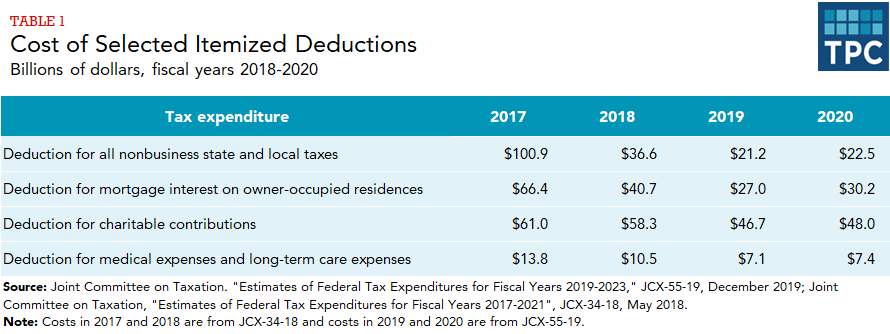

For married taxpayers filing. Todays announcement does not affect state tax refunds received in 2018 for tax returns currently being filed. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

Single taxpayers and married couples filing separately 6350. Head of a household. The SALT workaround is an option for the 2021 tax year.

Is this the same number for single married filing jointly and married filing singly. If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. 12550 Single or Married Filing Separately.

The TCJA established a temporary SALT cap for tax years 2018 through 2025. Additional standard deduction for the aged or the blind. Head of household filers and married taxpayers filing jointly.

Their standard deduction amount is determined by the filing status as follows for Tax Year 2021. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Trying to figure out how much of our 2018 state refund went over the 10k SALT cap.

If you live in a high tax state youd be wondering how that is going to. Hello Its my first time filing a joint return for 2019 year. 52 rows The deduction has a cap of 5000 if your filing status is married filing.

52 rows The deduction has a cap of 5000 if your filing status is married filing. In the 2017 Tax Cuts and Jobs Act the federal government enacted a 10000 limit for joint and individual filers and a 5000 limit for married couples filing separately. The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Salt cap of 10000. Your Income Bracket and the SALT Cap Impact.

Do we combine our state and local income taxes and real estate taxes together and figure out. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. The debate over whether to include SALT cap repeal in the budget resolution has proven contentious as the benefits of the proposed tax cuts flow.

New tax law for 2018. By limiting the SALT deduction available to certain taxpayers the SALT cap decreases the tax savings associated with the deduction. If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize.

For example policymakers have proposed doubling the cap for married couples or making it more generous. Today the limit is 750000. How Does The Deduction For State And Local Taxes Work Tax Policy Center Salt cap of 10000.

Married couples filing jointly. For 2021 the standard deductions are 12550 for single filers or 25100 for married couples filing together meaning they wont itemize if write-offs including SALT medical expenses. An individual would qualify to itemize their deductions if their total itemized deductions entered on Schedule A exceed their standard deduction.

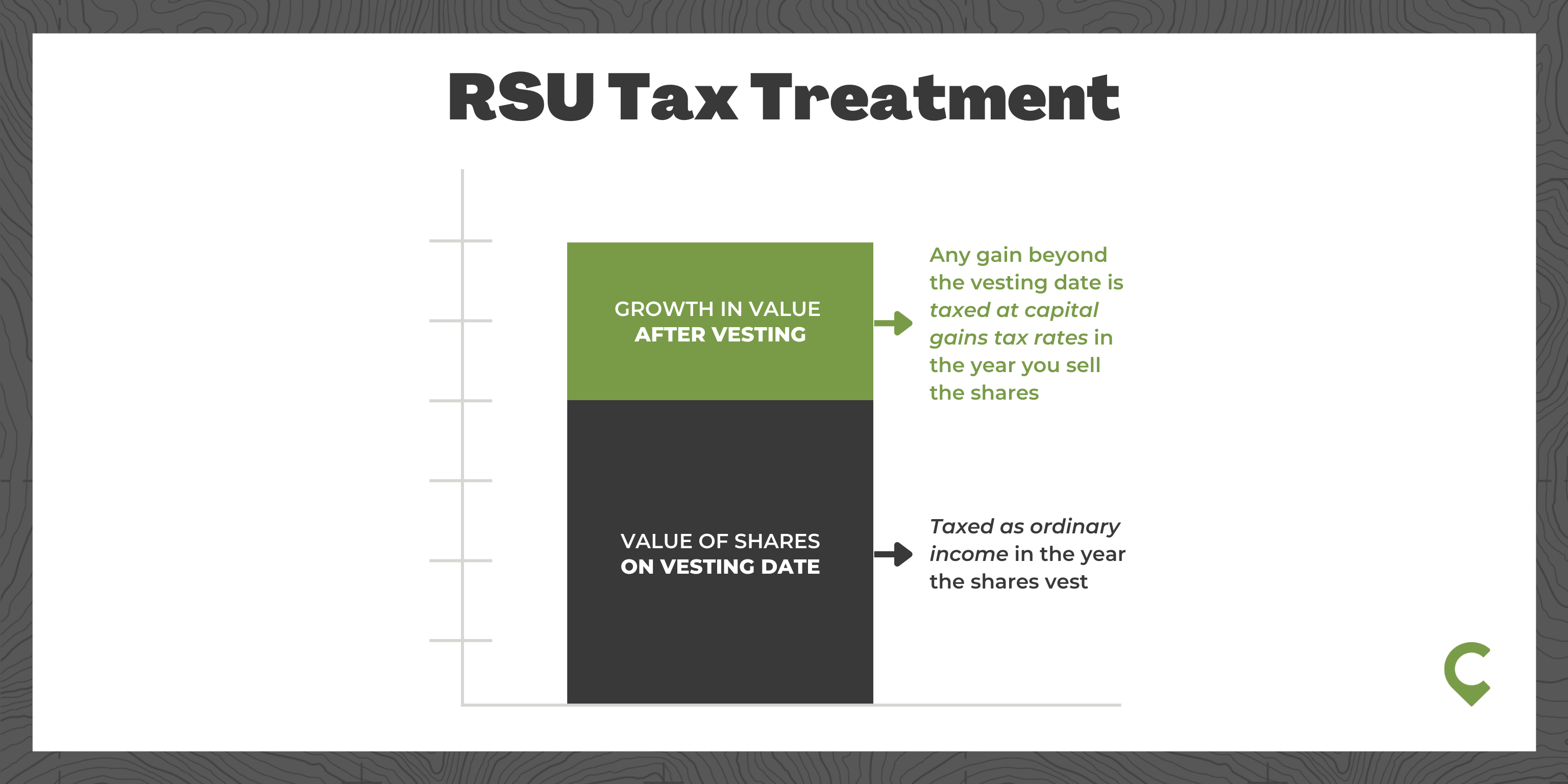

The Tax Cuts and Jobs Act TCJA enacted in December 2017 limited the itemized deduction for state and local taxes to 5000 for a married person filing a separate return and 10000 for all other tax filers. However Becourtney said the 10000 SALT deduction limit is only applicable to taxpayers with a single married joint or head of household filing status. As alternatives to a full repeal of the cap lawmakers and experts have proposed a number of changes to the SALT deduction.

Pdf Introduction Some lawmakers are seeking to repeal the 10000 cap for single and married couples jointly filing on state and local tax SALT deductions put in place under the Tax Cuts and Jobs Act TCJA. Is it 5000 for Married Filing Separately. Under tcja the salt deduction was capped at 10000 for single filers and married couples filing jointly.

The limit is 5000 if married filing.

Salt Deduction Cap To Get Meaningful Fix Democrats Say Bloomberg

Your 2020 Guide To Tax Deductions The Motley Fool

Charitable Intentions Methods To Maximize Your Impact And Minimize Taxes Fi3 Advisors

Pennsylvania Tax Rate H R Block

What Are Itemized Deductions And Who Claims Them Tax Policy Center

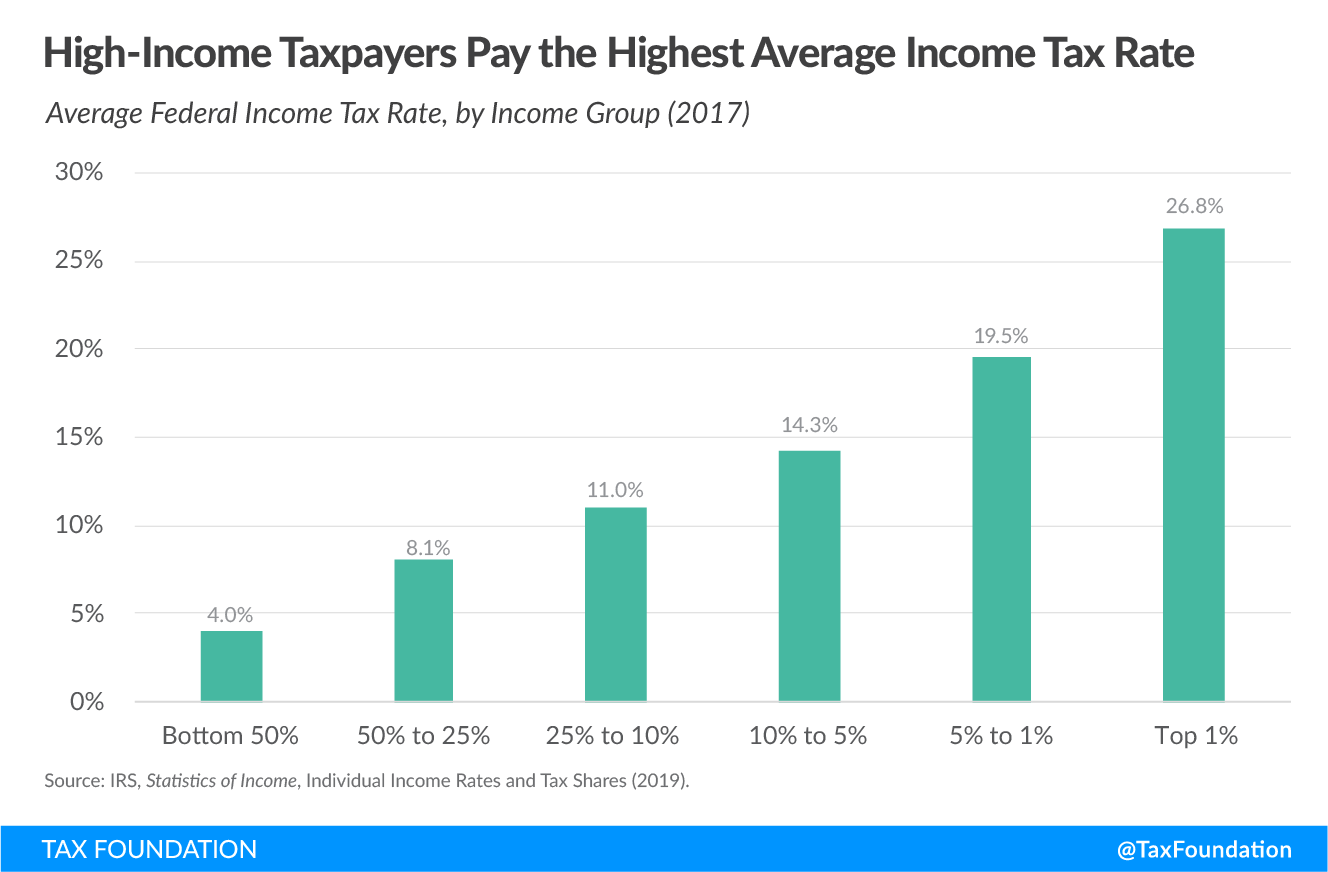

Average Tax Rate Definition Taxedu Tax Foundation

The Truth About How Much Americans Are Paying In Taxes The Heritage Foundation

Average Tax Rate Definition Taxedu Tax Foundation

Average Tax Rate Definition Taxedu Tax Foundation

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Home Ownership Matters 3 Key Changes For Homeowners Under The New Tax Law Key Change Homeowner Change

What Are Itemized Deductions And Who Claims Them Tax Policy Center

:max_bytes(150000):strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

:strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)